Algo trading: What it means for Stock market?

22.07.2020

Algo Trading's gained a big popularity in both Stock and Derivatives markets. These markets let you implement all features of algotrading.It's very common nowadays to use

automated trading software and

trading advisors by both big corporate and private companies. In both cases the competent use of the capabilities of

robots is a vital tool which can reduce the risk that the level of profits forecasted might not be achieved along with all possible losses. The most active

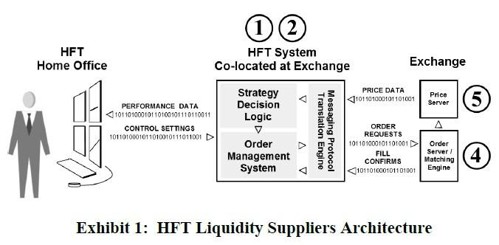

market maker is typically a large bank or institution, some of them are HFT divisions of Deutsche Bank, Goldman Sachs, Morgan Stanley and so on.

Let's review some types of

algotrading which are widely used in Stock market:

- Trading systems which use technical indicators which can help to predict market performance and behaviour.

- Trading robots that use a ratio on several tools, which have a relatively large percentage of correlation while it is not equal to 1. Tracking the deviations of these tools, the robot is selling and buying making a profit.

- Broadly, a market maker is a trader that provides liquidity to both buy and sell products. Without market makers, there would likely be little liquidity and the system works because of market liquidity. The market maker get benefits and rewards from the trading platforms regardless the profit or loss.

With our programs, such as

S#.Shell и

S#.API you can create any types of trading robot. The software let your ability to create your own graphic interface to work with, and the API library can create a whole trading system. More detailed information you can find on our

website.