The growth of activity in the world markets among traders, as well as the constant progress of technology, led to an increase in the

speed of actions carried out by players on the trading floor.

Today, many traders actively

working with various financial instruments prefer

trading robots rather than manual trading. This is largely due to the

speed of operations and their volume.

Let's see, what is a trading robot? A

trading robot is a

special program created by a

special algorithm, according to which it conducts trading operations. [nerd]

Let's take a closer look at the features of such programs.

The

trading robot program allows you to

fully or partially take over the process of working on the trading floor. The trader, as the operator of the trading robot, has the possibility of

full control over it, which allows the robot to adjust the trading robot,

make changes to the program code or change the algorithm.

The trading robot in Autonomous operation independently

makes decisions on orders and transactions, according to the established criteria of its algorithm, with intervention in the user's process, operations can be carried out in

manual mode.

The

program code of the trading robot is

based on calculated and thought-out mathematical sequences. Keeping track of different data such as

indexes, indicators and other market data obtained from the exchange. The trading robot program decides whether to buy or sell certain assets. The

speed of reaction to market changes, allows the trading robot to make much more transactions, respectively, potentially bring greater profits and reduce losses. [nerd]

Let's return to the main task of the trading robot. We can say that the task of a trading robot to simplify trading for a trader is not the main one. The

main task of the trading robot is to be able to

implement through programming trading algorithms that are difficult or impossible to implement in manual trading. Simply put, a trading robot is a set sequence of actions for making a trade.

From the total mass of trading robots, it is necessary to distinguish three main groups that differ in the algorithm of work or the type of strategy.

-

Trend (directional) or directional;-

Countertrend;

-

Arbitral.

Let us consider in more detail the features of each type of trading robots.

1.

Trend or directional robots. The purpose of the robot is the

fastest response to the trend of the market, in other words to track in which direction the market has turned. Depending on the direction, the trading robot automatically opens a position either by selling or buying. Accordingly, if the market changes its direction, the trading robot performs the opposite action as quickly as possible, opening a position.

2.

Countertrend trading robots. Their goal is to

track price rollbacks. This trading robot monitors price rollbacks occurring in the flat position of the market and places orders based on the established algorithm.

3.

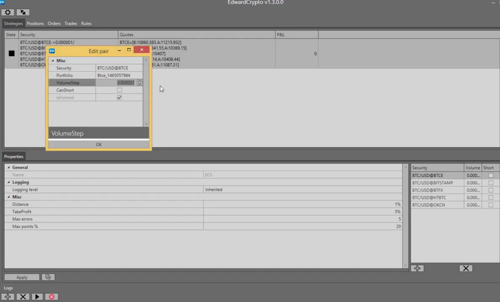

Arbitrage trading robot. This trading robot is

almost the most popular type. A trading robot such as "

Edward", for example, makes a profit by

determining price differences between similar or identical instruments in different markets. In fact, he buys in one market, sells in another, compensating for the difference and making a profit.

Another way is the separation of robots:

-

Candlestick. These are trading robots that use

candlestick data to determine signals for placing orders.

-

Indicator. These robots use

indicator data to open an order.

Let's talk about building a trading robot. The very

writing of program code is not a difficult task, reduced to the knowledge of programming languages. It is much more difficult to find the

right way to create a trading algorithm on the basis of which a trading robot is created.

Today, up to 50% of transactions on trading platforms are made by trading robots. Trading robots are rightfully considered one of the most reliable and effective trading tools. There's an explanation :

-

Trading robot simplifies the work of transactions with a large volume of the lot, dividing the application into smaller parts and making transactions in parts;-

Trading robot reduces the labor of the trader, making trading operations automatically. This contributes to an increase in the volume of transactions, increase the profits that trade brings, and, importantly, reduces the possible loss;

- While remaining automatic, the trading robot can always be switched to manual mode, that is, it remains completely under the control of its owner;

- A huge list of tools and methods that can be used by a trading robot, allow us to say that the trading robot makes it possible to realize the most complex mathematical problems for trading;

- The trading robot does not have the criterion of emotionality, in fact, it soberly operates its inherent mechanism. Does not panic in a stressful situation.

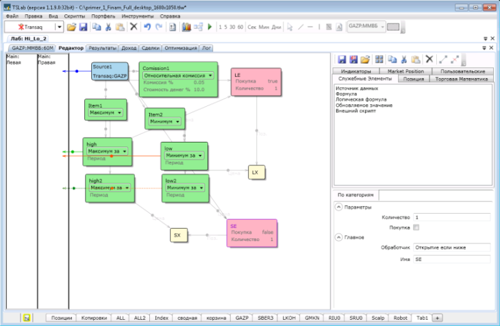

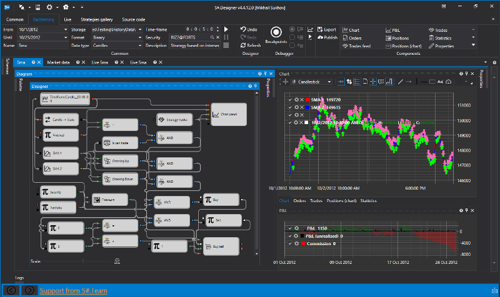

When analyzing trading robots, a trader must choose the

right path for himself, on the basis of which he will be able to choose a robot for himself. A trader should understand that a

trading robot is not decision for 100% success. In addition to the trader, it is important to know the platform for the implementation of such trading robots. There are quite a lot of them (TSlab,

S#.Designer).

Summing up, we can say that the

trading robot is reliable and convenient functionality in the arms of the trader, the most important thing is to use it correctly when conducting exchange trading.