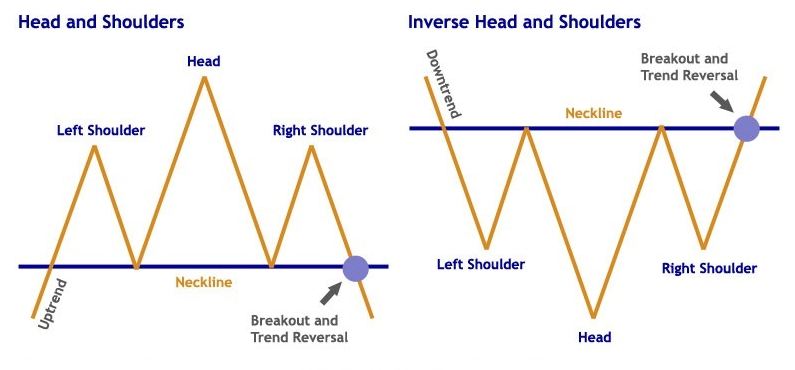

💥The Head and Shoulders pattern is a popular reversal pattern in technical analysis. It is named after its appearance on the chart, which resembles a head with two shoulders. The pattern indicates a potential reversal of an uptrend and a change in market direction.

💥The Head and Shoulders pattern is formed by three peaks, with the middle peak being the highest. The left and right peaks are almost equal in height, and the pattern is completed when the price breaks below the neckline, which is the level connecting the two troughs between the peaks.

💥Traders often use the Head and Shoulders pattern to identify entry and exit points in a trade. Once the pattern is confirmed, traders may enter a short position, targeting a price decline equal to the distance from the head to the neckline. Stop-loss orders can be placed above the right shoulder to protect against a potential false breakout.

💥💥It's important to note that the Head and Shoulders pattern should not be used in isolation and should be confirmed by other technical indicators and analysis.

💥Reversal patterns are patterns that indicate that the trend that occurred in the past is likely to disappear, and new trends that are opposite of the old are likely to arise. For example, if the previous trend was an uptrend, a reversal pattern indicates that the uptrend is ending, while a downtrend is likely to follow. If the original trend was a downtrend, a reversal pattern would mean that the downtrend is about to end, while an uptrend is likely to follow.

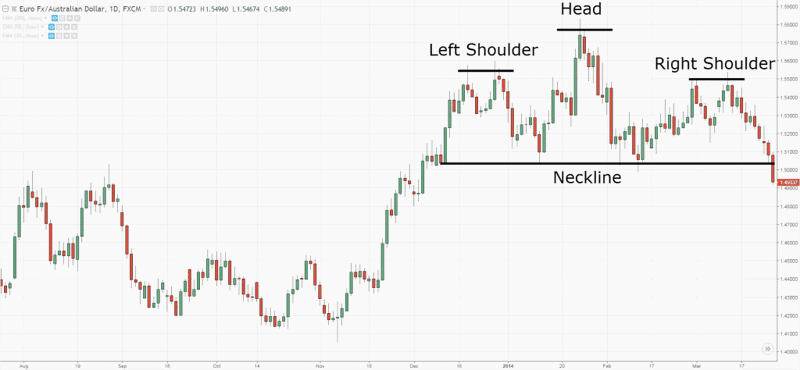

💥From the picture, you can see that the trend was originally an uptrend, with the number of volumes rising accordingly, which is one feature that enhances the movement as an uptrend, before the left shoulder point. After that, it begins to adjust to the bottom (neckline), but you will notice that the number of volumes decreased compared to the previous period. Since many traders still believe that this downtrend is just a minor adjustment in the big uptrend, there are not many stocks to be sold out because they are afraid that if they sell out, they can't buy back (the buyback price will be higher than when it was sold), which is what traders expect. In the next period, the price rebounds from the uptrend line up to the head point, which is higher than the left shoulder point. The number of volumes increases accordingly because everyone is still looking at the picture as an uptrend.

💥After that, it starts to decline again, but at this moment, it can't be said for certain that the first vertex is the left shoulder and the second vertex is the head because it is still in an uptrend. This downward adjustment is down to test the uptrend line again. The initial number of volumes may not be too noticeable, but when it reaches the receiving point on the uptrend line, it appears that the support is not there, and thus, the uptrend line breaks down.

💥Now everyone is starting to realize that there will be a serious downturn, causing a lot of selling resulting in higher trading volume. The price continues to weaken until the bottom of the 2nd trough (neckline) and then starts to gain strength back, causing a rebound in the volume price. However, the number of volumes is not as much as in the past, as everyone is not sure if the downturn will actually happen. There is a possibility of further downward adjustments until the point of the right shoulder, causing a sales force by people who sell at low prices to make a profit first. This point will increase the beliefs of many parties, who may start to see a pattern of the left shoulder head up, and where they are now is most likely the right shoulder. However, to confirm the occurrence of the right shoulder, the bottom point of the shoulder groove (point 2) must not be higher than the first vertex, and the 3rd peak (the right shoulder) must not go above the head (the 2nd peak). This downward adjustment will have a large number of volumes, confirming the decline, especially when it breaks down the neckline.

💥💥One important point to note about the neckline in an uptrend is that it must not have a negative slope to be a real Head & Shoulders pattern.

💥By now, everyone can see that the head & shoulders pattern is perfect. Will they stop playing now? It's unlikely! There are still some groups that know that even head & shoulders can still play out. That is, after discarding the right shoulder point until the price falls through the neckline, in principle, it can be analyzed that the level that falls below the neckline, down to a distance equal to or close to the distance measured from the head down to the neckline, will begin to be targeted. As a result, there may be a rebound, but the number of volumes will not be as much.

💥Because it is a short play, these groups will be prepared to set up a sell-off again at the 4th vertex in order not to go beyond the neckline. The pattern seen after the head is a downtrend.

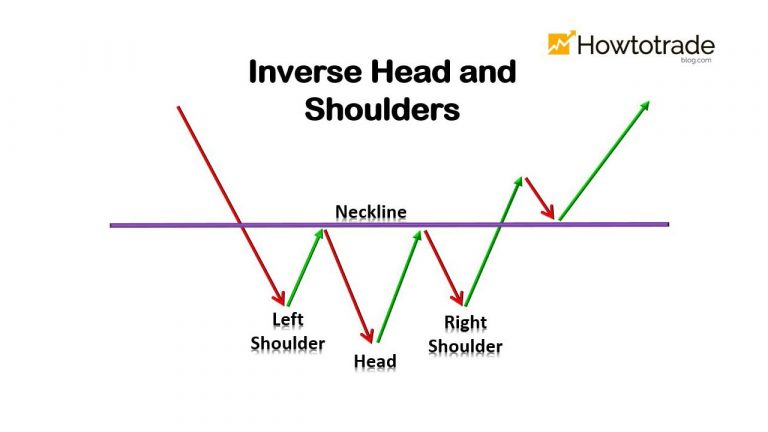

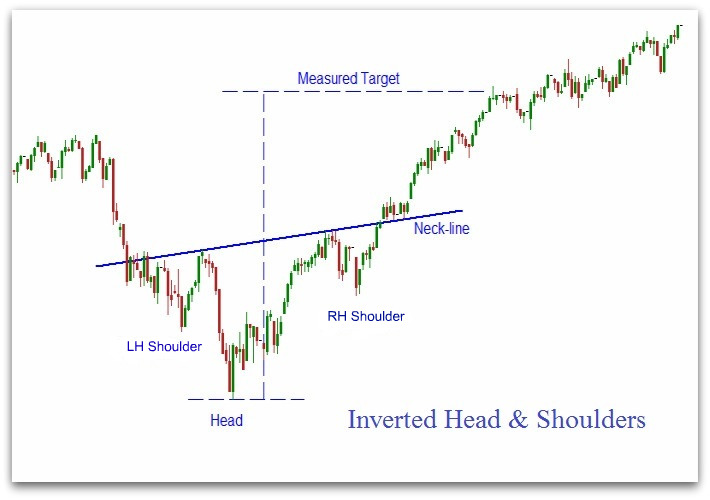

💥In the case of a trend shift from downtrend to uptrend, the pattern is referred to as a reverse head & shoulders. Before the first and second bottoms, the market is still in a downtrend phase, and stocks are sold in large quantities. During the rebound after the first peak, trading volume is relatively low because traders understand that it is just an uptrend in a big downtrend. However, after the second bottom, traders may believe that the prices are already low enough and start to collect stocks, leading to a continued increase in price. When the price breaks through the resistance of the downtrend line, there will be buying pressure to further strengthen the move, and the number of volumes will increase accordingly. However, the move will still be limited by the neckline, and only the second vertex will be adjusted downwards, leaving a possibility of a right shoulder formation.

💥However, traders know that this downturn is just a temporary adjustment. Since the downtrend line has already been crossed, there is no stock drain. Assuming the right shoulder formation is complete at the 3rd bottom, the right shoulder fissure (the 2nd vertex) cannot be lower than the first bottom point and the right shoulder (3rd bottom point) must not be lower than the head (the 3rd peak). After that, there is another upward movement with buying pressure sweeping into another wave, causing the neckline to break up and being confirmed by the presence of a sufficiently large volume. In the next period, not everyone sells out much because they have begun to believe that the trend has changed from downtrend to uptrend, and that the neckline in this case must not have a negative slope.