Today we’re going to talk about one of the most important financial instruments is an

order book. It is formed by all sell and buy orders on

crypto exchange.

An order book is the list of orders which uses to record the interest of buyers and sellers of chosen cryptocurrency for fiat money or any other cryptocurrency and taking in consideration the closest price of trading pair.[laugh]

Sometimes it's crucial [ninja],

especially in arbitrage, to have an opportunity to trade with several order books at the same time. This option is fully implemented in

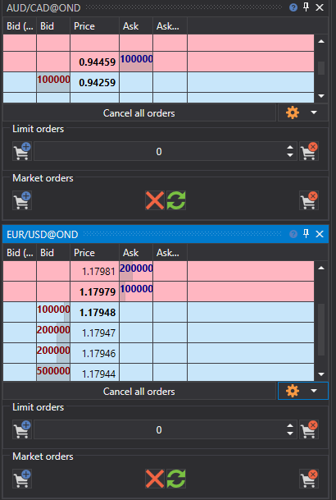

S# programs. For instance, the working area of free trading

terminal S#,

Terminal allows the trader to configure it so that it would has the very informative picture of the whole trading process. [nerd]

Every order book gives the full information about the volume offer and its price

Every order book gives the full information about the volume offer and its price. The number of offers is the

order book depth.

The ability to customize the book order depth also is important part of trade, as it gives you the ability to see the whole list of offers. It's often that in the upper part of order book are placed bid offers and in the down part is ask offers of selected security.[happy][love]

By fact, the order book shows the desire of trading of cryptocurrency at a favorable rate of a trade for a trader. When an opposite trade is appeared, trade is executed, and the pair price is changing in the direction of the executed trade.

If the order doesn't have any counter offers, then it remains without any changes until the counteroffer moment or the cancel it by trader.What we see on the picture that based on data of the

order book, a trader can perform the analysis or make decision about trade move on. So for example, a trader can determine the spread of a traded pair (the difference between the first values of the bid and ask prices), as well as predict the behaviour of graph chart (if there is large buy orders, then rapid growth is highly likely, and vice versa). Therefore, having the option to customize the book order, the trader get a great flexibility in a trade that will bring a big profit and/or lesser risks.