Earlier in the articles, we considered such mechanisms used in trading as

Stop-Loss and

Take Profit.

Of course, these two tools help reduce the risk and increase the profitability of the strategy. But what if, because of them, we limit ourselves to getting more profit?

To understand how this can be done, you need to consider

Pyramiding.

What is

pyramiding - оne of the types of strategy aimed at increasing capital by step-by-step opening of several transactions with a favorable trend. Using this strategy allows the trader to get a stable income.

Let's consider the principle of pyramiding.

The essence of pyramiding is that after the profitable result of the last transaction, the trader opens a new position, while doubling the bid, compared to the previous one. As for the risk arising from the next bid, it is equal to the sum of the profit of the previous stage and the initial bid. At the same time, the amount of profit depends on the so-called "steps" of pyramiding, and it grows exponentially.

Pyramiding is applicable in any market – stock, currency, and others.

Pyramiding is applicable in any market – stock, currency, and others. The trader adds a new position to the previous effective one, if the trend direction is profitable for him.

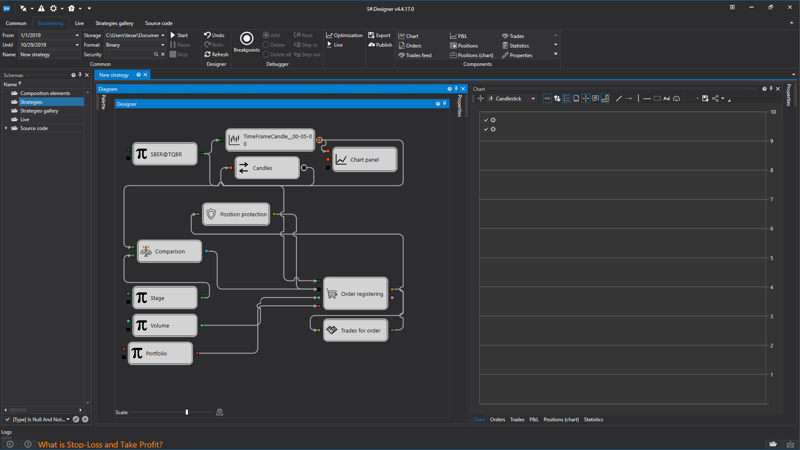

If the trader's actions are calculated correctly, he will always be in profit. The use of various trading robots also contributes to a more convenient use of pyramiding. For example,

"Mr. Hyde" from StockSharp, which in automatic mode and flexible configuration can trade in pyramiding mode.

An important point is that the trader must be sure that the trend is stable, otherwise it can lead to losses. However, the use of automated programs, such as

Designer, which use

condition cubes and position protection, makes trading with pyramiding minimally risky. An example of this strategy is shown below.

Let's consider the basic rules of pyramiding.- Constantly monitor the ratio of return and risk within 1 to 2, so that the previous yield can cover the current risk.

Let's consider the basic rules of pyramiding.- Constantly monitor the ratio of return and risk within 1 to 2, so that the previous yield can cover the current risk.

- All parameters used during trading must be calculated in advance before entering the market.

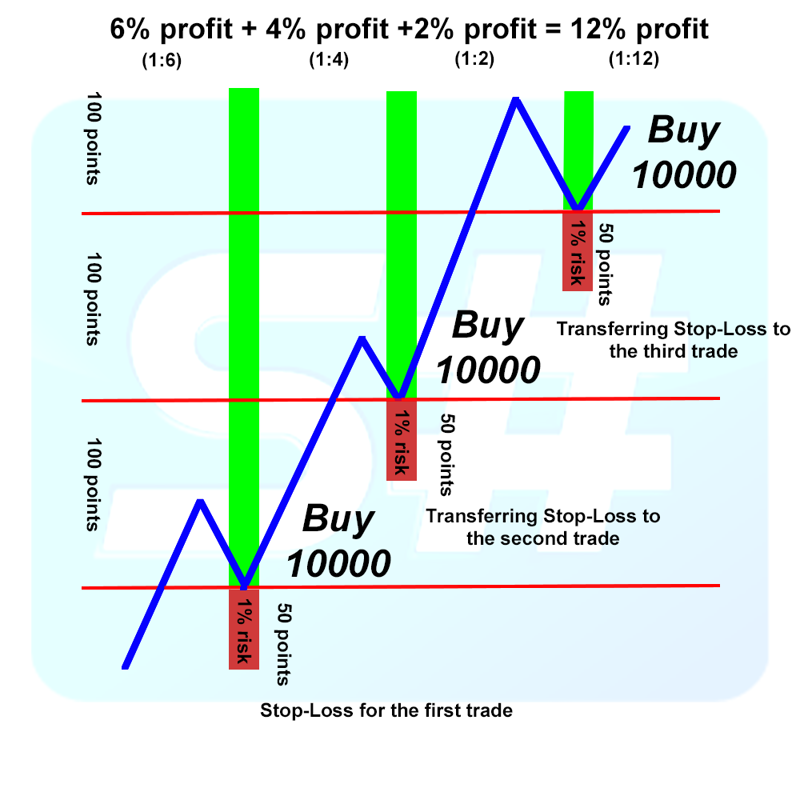

- Use pyramiding only on a stable trend.Let's look at an example of using pyramiding.Let the trader have a capital of $10,000. At each main level, it can buy 10,000 units of the selected currency. In the Forex market, this is 1 mini lot. The amount of profit at each stage will differ, however, the size of the set Stop-Loss for each opened transaction will be equal to 50 points.

So, the trader buys 10,000 units of the base currency. Let's assume that the market situation is shown in the figure.

The price rises and breaks through the resistance level, now this level becomes the support level.

Let a bullish pin bar be formed at the support level (a graphical analysis figure based on the non-indicator method of trading, as well as the analysis of Price Action charts), in consequence of which the trader decides to buy 10,000 units of currency. When a trade is opened, the trader sets the Stop-Loss at 50 points or 1% of the risk of capital.

This way the trend keeps its direction, and the trader trades further. The trend breaks the next level, and the price is set above the support level, and the trader buys another 10,000 units, and the previous Stop-Loss is transferred to the new level.

The same situation is when the price breaks the third level

Thus, the trader accumulates a long position of 30,000 units of the main currency by the third stage. There is almost no risk, since at the third stage, when a deal is concluded for 10,000 units, the profit will be

4% if the trend reverses.

The potential profit, with a successful outcome, can be

12%.

Let's look at this example in numbers.

It is important to see how the possible profit increases from each stage to the next, while reducing the risk

The trader's first trade will bring him a profit of 6% of the initial capital.

Consider all the situations in the market:-

First transaction: 10,000 units

Negative: there was a -1% loss

Positive result: +6% in profit-

Second transaction: 10,000 units

Negative result: no loss (+2%in profit from the first stage and -1% in loss from the second)

Positive result: +10% in profit (+6% in profit from the first stage and +4% in profit from the second)-

Third transaction: 10,000 units

Negative result: +4% in profit (+3%in profit from the first stage, +2% in profit from the second stage and -1% in loss from the third)

Positive result: +12% in profit (+6% in profit from the first stage, +4% in profit from the second stage and +2% in profit from the third)As you can see, the risk is about 1%, while with positive trading of all three stages, the profit will be 12%Main advantages and disadvantages of building:Plus:-

Pyramiding strategy allows you to increase your income with minimal risk;Minus:-

The strategy is quite complex and requires experience. It is possible to use the strategy for medium or long periods of time, preferably using automated trading systems. The correct calculation of the exit point from pyramiding, analysis and testing of the trend behavior is of great importance, which necessarily leads to the use of trading robots. Pyramiding is not suitable for scalping strategies, and is also aimed at long-term trading.Pyramiding is a profitable and relatively safe method of trading. Its reliability has a downside in the duration of the process, the accumulation of sufficient experience and knowledge in trading that would correctly calculate the levels of trade. Also, this type of trading is not suitable for all traders, so choosing it as the main one should be conscious.