Stop-Loss-a type of order whose task is to set limits on possible trading losses.This order is

used automatically using automated trading systems, which we will discuss later. The essence is very simple: with the help of the

Stop-Loss mechanism, when the set price level of the purchased asset (instrument) is reached, the position is closed. In fact,

Stop-Loss insures the trader from an unplanned price drop.

This restriction mechanism is widely used for traders. It is used by experienced participants in the financial market, but novice traders often neglect this mechanism, although for them Stop-loss is almost the main method of saving their funds in a positive balance.

Stop-Loss

Stop-Loss, from a technical point of view,

is a regular pending order that has an activation mechanism when the set price level of the asset is reached. The difference between the two types of pending orders is that when using a regular pending order, a new deal is opened, and when using a Stop loss, an existing one is closed.

As mentioned earlier, an important advantage of Stop-Loss Is the automation of the process, which eliminates the need to track price changes and make a decision manually. Of course, this reduces trading losses and time, which is fundamental for high-frequency algorithmic trading (HFT).

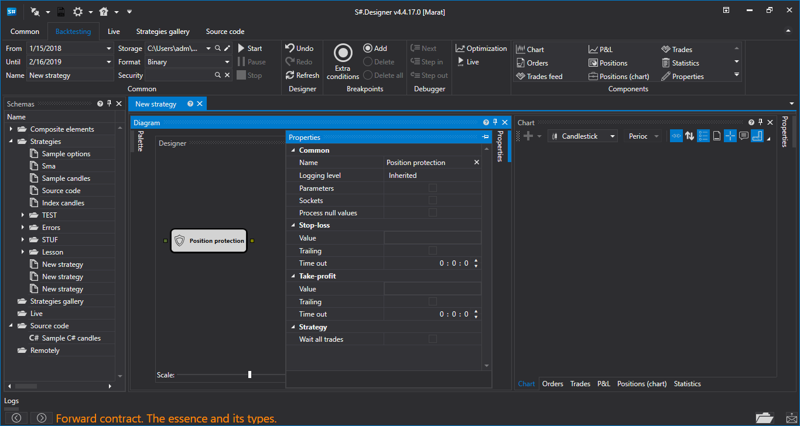

For example, in the program for creating trading robots

Designer, it is possible to use the Stop-Loss mechanism by using the

position protection cube, which can be configured and used as a reliable tool for reducing losses.

The use of the Stop-Loss pending order mechanism is widely used to reduce trading costs caused by losses

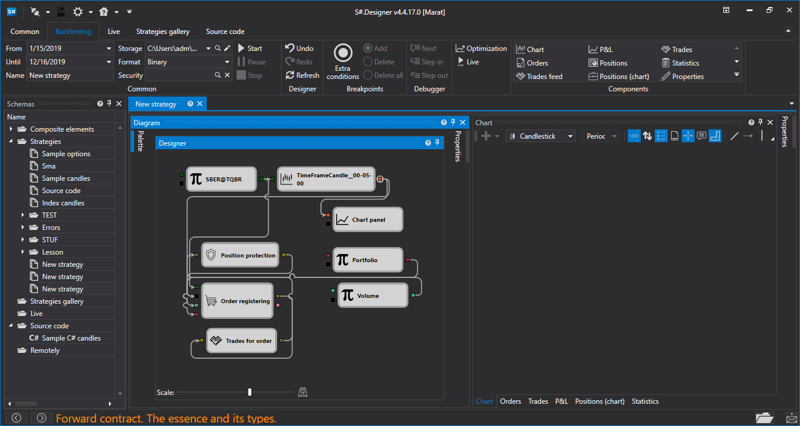

The use of the Stop-Loss pending order mechanism is widely used to reduce trading costs caused by losses. As a result, this leads to an increase in profits, not only by increasing the volume of successful operations, but also by reducing the volume of unprofitable ones. The

use of this tool in trading strategies is now increasingly used, as it reduces losses, increasing the amount of profit at a constant (regulated) amount of transaction costs. Example of a trading strategy executed in the

Designer program.

So, the main advantages that are inherent in a pending Stop-Loss order:- Using a pending Stop-Loss order in trading strategies allows you to limit losses on a single trade by setting the loss level that is set by the trader himself, which makes the trading strategy more flexible and less risky.

So, the main advantages that are inherent in a pending Stop-Loss order:- Using a pending Stop-Loss order in trading strategies allows you to limit losses on a single trade by setting the loss level that is set by the trader himself, which makes the trading strategy more flexible and less risky.

- The use of this pending order insures the trader from an unpredictable situation in the market, in which the asset value may collapse, thereby protecting the user of the trading strategy from losing capital.

- Regulation of possible losses also has a positive effect on the trader's emotional state, preserving his nerves and psychological health.There are a lot of reasons in the market that can cause a loss, and the frequency of their occurrence is unpredictable. However, the use of Stop-Loss allows you to protect yourself, make trading more convenient, limit risk, maximize profit, reduce the time to work with a trading strategy, and reduce the risk to emotional health.

An important point for working with a pending Stop-Loss order is to calculate the correct order level.

When placing an order, you need to know the following:- First of all, a Stop-Loss order is a conditional order that is executed when the set price level is reached.

- The application consists of two parts: the application and the condition for its execution (conditions that are edited by the trader, and when a new condition is set, the old conditions are canceled).

- The request is located on the broker's server, through which the trade is carried out, and is sent only when the necessary condition is reached.Let's look at the most well-known methods of working with Stop Loss:- Fixed Stop-Loss:

The trader sets the value in the tool settings equal to the number of points from the initial price of the asset to open the order.

- Flexible Stop-Loss:

A more flexible method that takes the result of market analysis (minimum and maximum prices for an asset for a period, price change charts, and other analysis tools) as the basis for setting the opening price value. This is a more complex, but more reliable method than the previous one.

- Break-even trading:

A rather complex method aimed at dynamically changing the set Stop-Loss level by moving the set value from the drawdown area to the guaranteed profit area at a time when the price has already changed significantly in the set direction.

- Trailing stop:

A more advanced method of the previous method, which involves automatic means of transferring the Stop-Loss level.

- Trend:

We will devote a separate article to this method and analyze it later.

Let's add a few more words and talk about Take Profit.Just like Stop-Loss,

Take Profit is a pending order aimed at fixing profits. When the asset price reaches the price set by the trader, the order is executed, and the trader makes a profit by closing the position.

The level of execution of Take Profit is set by the trader himself, and as in the case of Stop-Loss, it is often used with the use of automated trading systems, trading robots and trading systems.

This type of order - limit, is executed only when the asset price reaches a predetermined level.

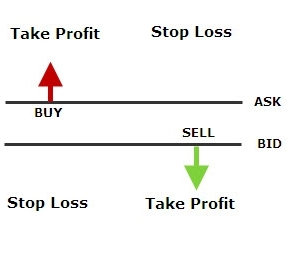

There are two types of "entry into a position" - the beginning of trading operations:- Long position (long, long, buy) - purchase request;

- Short position (short, short, sell) - request for sale.If we start trading with a purchase, we set the take Profit order execution level above the asset purchase price.

If we start trading with a sale, we set the take Profit order execution level below the asset's sale price.

In conclusion, it is worth mentioning the ratio of the orders considered.

In conclusion, it is worth mentioning the ratio of the orders considered.Using both orders reduces the risk of loss and increases profit. The use of both of these orders in each of the trading situations is purely individual, it is impossible to say unequivocally what is most applicable, what is least. The level of use of pending orders is determined by the trader, in relation to each situation and trading strategy separately.

However, the combination of techniques with the use of pending orders and trading robots makes it possible to facilitate the work of the trader, makes it possible to concentrate on analysis, reducing the time to track the situation on the stock market.