Previously, we considered such instruments as

futures and

options,

which are exchange-traded instruments. However, there are also

non-exchange instruments.

Forward or forward contract – a contract (agreement) under which the seller must transfer the underlying asset specified in the contract to the buyer within the period specified in the contract or perform an equivalent monetary compensation.The buyer undertakes to accept and pay for the asset, on the basis of which the seller and the buyer determine the financial obligations determined by the size of the indicators of the underlying asset, at the time of their execution, in accordance with the procedure specified in the forward contract.

In essence, a forward contract is a bilateral agreement on the acquisition of a basic asset, drawn up in accordance with the established form. The forward establishes obligations of one party to the other party to sell or buy an asset at a certain time and on accepted terms, the price of which is fixed and set by the terms of the contract.

We can say that a

forward is a binding contract that has its own term of execution set by the parties (buyer - seller), an established asset and its volume, as well as a fixed price for this asset at the time of execution.

Let's look at what conditions should be set in the forward contract:- The subject of the forward contract or the asset being sold in the forward contract. Such an asset can be: a commodity, various financial instruments;

- The volume of the asset, the volume to be delivered, and the volume is specified in the corresponding units of the asset;

- The date on which the asset should be placed. The date is fixed and cannot be changed;

- Execution price of the forward contract. Amount to be paid;

- Forward price. Differs from the fixed price specified in the forward in that it is variable and is determined at the current time as the current price of forward contracts for the corresponding asset.Let's consider what features a forward has:- Forward contracts are concluded outside the exchange, for example, in contrast to the option or futures; - The forward period can be set by anyone determined only by the parties to the contract;

- The forward period can be set by anyone determined only by the parties to the contract;

- Forward contracts do not have strictly defined forms;

- There is no need to submit reports on forward contracts;

- The forward contract cannot be terminated or changed;

- Can be compiled in a convenient form for customers;

- A forward contract is not retroactive;

- There is no Commission for drawing up a forward contract.

Pros and cons of forwards.Speaking about the positive aspects of forward contracts, it is worth highlighting the following points:

- Fixed price on the execution date;

- No commissions for concluding contracts.The negative point is that when the

forward price changes relative to the settlement day price for it, the contract participants do not have the opportunity to terminate the contract.

In fact, the participants there is no possibility of maneuver, not the flexibility of the terms of the contract, does not allow to change the terms of the forward contract.Low liquidity caused by the lack of a secondary market for forwards and as a result the ability to resell the contract.What is the difference between forward contracts:- The forward is mandatory;

- The contract is drawn up taking into account the requirements of the transaction participant;

- Before the final conclusion of the contract, the following parameters are determined: forward volume, quality characteristics of the asset, delivery time and place of delivery. Let's look at the main types of forwards:- Delivery forward. It ends with the delivery of the underlying asset and payment in accordance with the terms of the contract;

Let's look at the main types of forwards:- Delivery forward. It ends with the delivery of the underlying asset and payment in accordance with the terms of the contract;

- Non-delivery or settlement forward. The forward does not end with the delivery of the underlying asset;

- Foreign currency forward contracts. In this type of forward, the parties exchange currency with a fixed rate under the contract.

Forwards are divided by the underlying asset:- Commodity forward, which implies tangible assets for purchase and sale (oil, gas, metal, agricultural products);

- Financial forward, which means financial instruments (currency, interest rates, shares, and other securities) as an asset.

There are forward contracts on the sides of a forward transaction:- Forward contracts between banking organizations or the Bank and the client;

- Forward contracts concluded by the manufacturer and seller of any product.Hedging mechanism for forward contracts.We told you earlier that

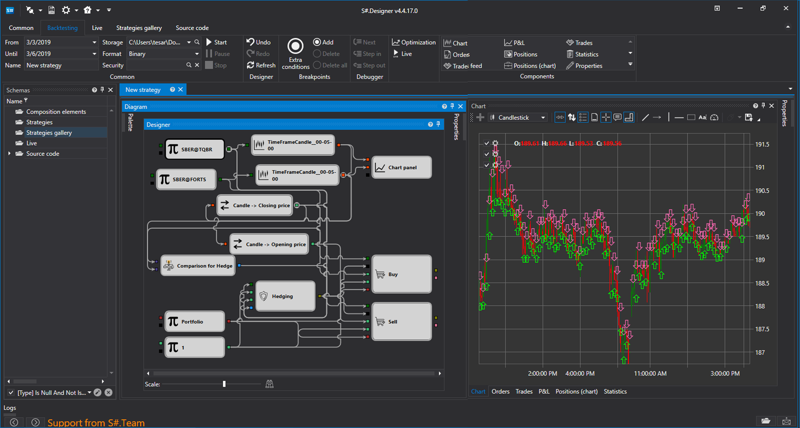

hedging is an operation to reduce the possible risk that occurs when entering into contracts caused by fluctuations in market prices. We also talked about tools that help you perform hedging operations, talking about the trading robot

"Hourglass" and using the set of functions of the

Designer program.

Most often, forwards hedge these types of risks:- Currency exchange rate caused by fluctuations in the exchange rate of various currencies;

Most often, forwards hedge these types of risks:- Currency exchange rate caused by fluctuations in the exchange rate of various currencies;

- Interest rate due to changes in securities quotations;- Product, due to the movement of the prices associated with inflation, political and different factors that affect the economy.

The use of a forward in operations is primarily an insurance against the changing market situation. Well-chosen forward conditions can give its participants the opportunity to protect themselves from adverse situations in the market. However, not very flexible forward conditions make it a little liquid, although it remains a fairly popular tool.